Online Account Opening

Deliver a frictionless, personalized, and omnichannel customer onboarding experience.

Request DemoDownload BrochureOnline Account Opening Software

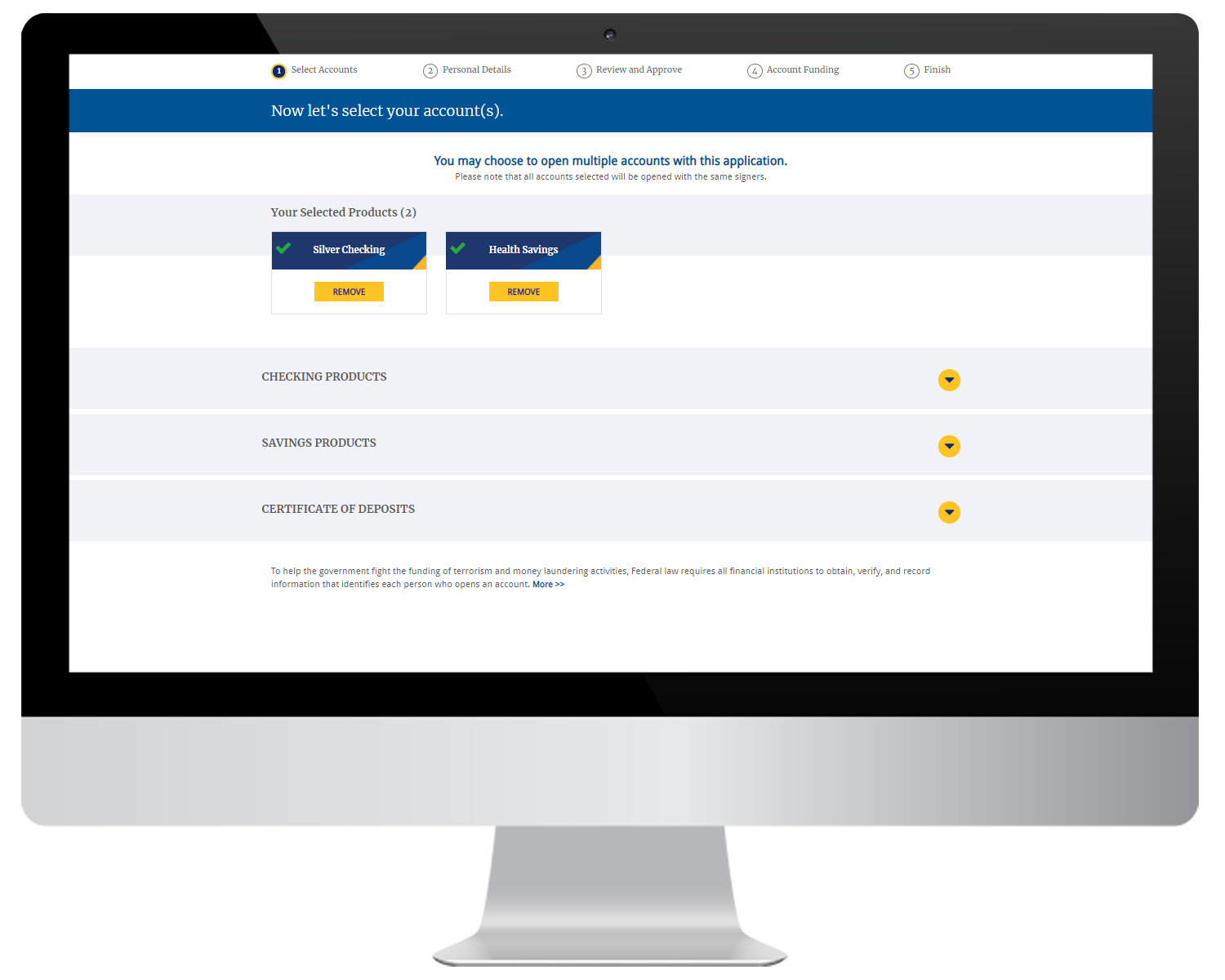

Accelerate customer acquisition, optimize costs, reduce abandonment rates, and deliver a superior customer experience with the help of a scalable and user-friendly online account opening software. Intuitively guide customers through the process with a portal-based solution, built on a low code digital automation platform. Ensure that your account opening interface is intelligent and responsive, allowing customers to initiate, pause, and complete their application across any mix of channels without losing their data. Additionally, empower your employees to upsell and cross-sell products based on customers’ dynamic needs.

Unified Platform for All Banking Products

- Single platform to handle all products such as savings, checking, CD, MMA, IRA, HSA, etc.

- Ability to handle consumer and business accounts online.

Omni-channel and Personalized On-boarding Experience

- Omni-channel support for online, in-branch and customer care channels

- Options to start, save, and complete application across multiple devices.

Information Capture and Upload

- Pre-fill of data from ID documents or existing customer records

- Easy document and signature upload using a variety of devices

Customer Verification and Risk Management

- Third-party integration with IDV/IDA vendors for automated decisions

- Automatic risk assessment through integration with fraud check software, AML/BSA systems, OFAC databases, etc.

Activity Tracking and Monitoring

- Process insights including application volumes, channels, abandonment rates, completion times etc.

- 360-degree business activity monitoring for a holistic view of the customer lifecycle

Seamless Integration with Third-party Systems

- Tight integration into core banking systems for instant account opening

- Integration with payment gateways and account aggregates for funding.

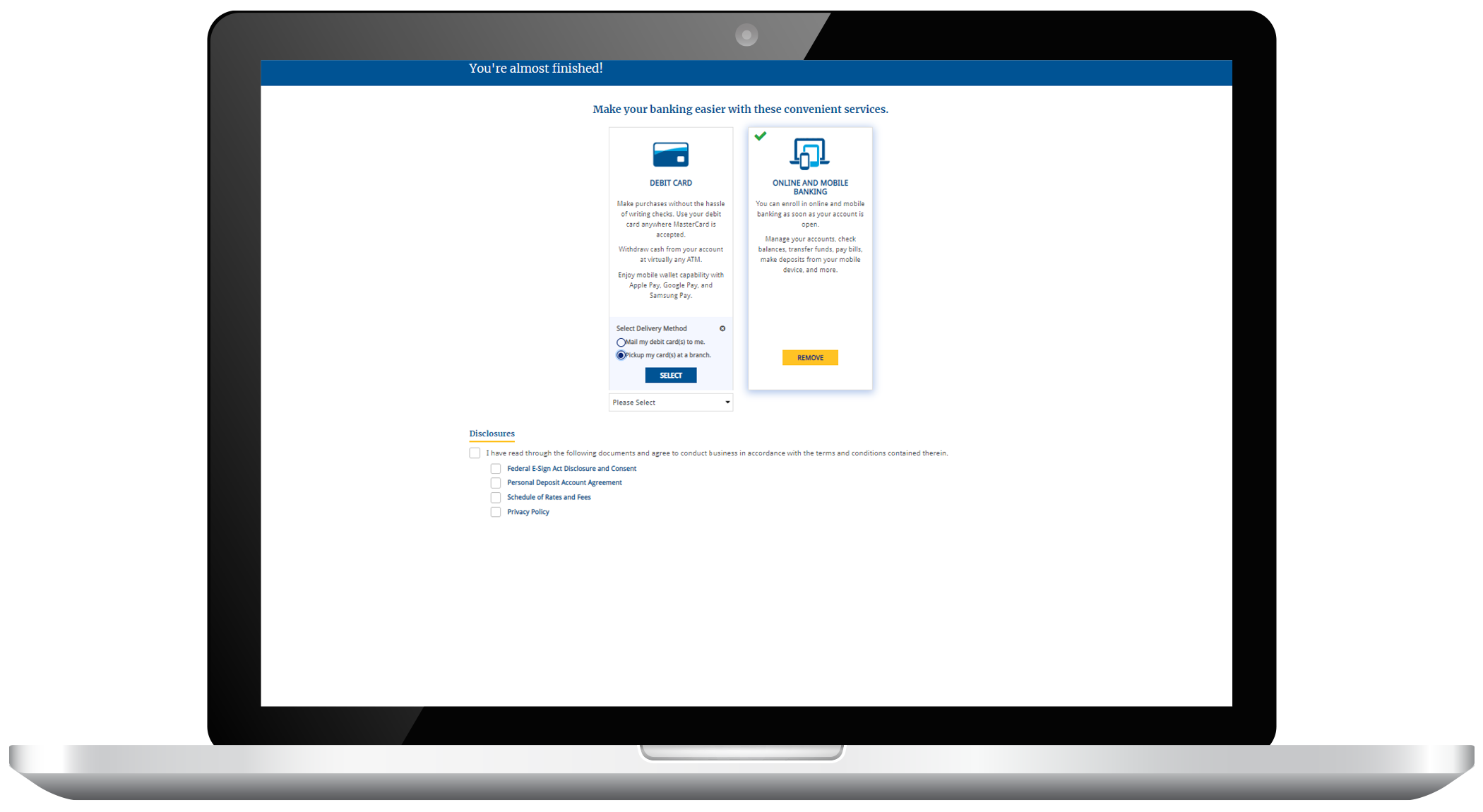

- Other integrations including online banking, CRM, IDV/IDA, eSign, card issuance, and check ordering

Customer On-boarding Activities

- Rule-based intelligent cross-selling and up-selling options

- Customer on-boarding activities including online banking enrollment and services setup

Ensuring Real Outcomes for Every Role

Responsible for overall business strategy, CEOs can leverage Newgen’s online account opening software to ensure cost efficiency while generating a higher customer lifetime value, increasing process visibility and control, and driving deposit growth to support the financial institution’s lending portfolio. All of this enables them to deliver:

- Increased profitability and revenue

- Faster account opening and higher volume of accounts opened

- Rapid deployment for a faster ROI

- Superior customer experience

- Enhanced adherence to compliance with regulatory requirements

COOs are responsible for streamlining operations, maintaining efficiencies, and ensuring real-time visibility and transparency across all processes. An online account opening software can help them seamlessly manage end-to-end operations, beginning with seamless account opening. Furthermore, it can help them achieve:

- Reduced customer acquisition costs

- Improved productivity and an optimized workforce

- Quicker account opening and customer onboarding

- Reduced operational costs

- Rapid and easy product additions and upgrades

With a focus on engaging and attracting customers, digital marketing managers can deliver timely, contextual communications, via customers’ channel of preference, by implementing a robust online account opening solution. By streamlining the account opening and onboarding processes, digital marketing managers can easily convert leads into customers and enable:

- Reduced abandonment rates

- Frictionless customer experience

- Increased up- and cross-selling

- Maximized straight-through processing

- Personalized, omnichannel communications

Responsible for ensuring compliance and mitigating risk, CCOs can leverage a purpose-built online account opening software to safeguard their organization. The software can help CCOs ensure compliance with dynamic regulatory requirements and enable:

- Comprehensive application checking

- Fraud prevention

- Easy auditing and compliance reporting

- BSA/AML and customer due diligence

- Improved data governance and management

Branch heads and operations managers are the “boots on the ground,” interacting directly with customers and responding to immediate needs. By implementing an online account opening solution, with omnichannel capabilities, they can streamline their customers’ experience, regardless of the channel of transaction, and ensure:

- Superior customer experience for branch walk-ins

- End-to-end visibility of branch staff and resource utilization

- Reduced turnaround times, across all channels

- Rapid exception management

- Continuous process improvement, in-branch and online

Integrations

Solutions for Financial Institutions

Success Stories

LEARN MORE

Panel Discussion

Step into 2022 Today with Digital Account Opening

On-Demand

Watch our panelists as they discuss the blueprint for a smooth and successful account opening ...

Video

Georgia’s Own Credit Union wins the ‘Newgen...

Watch this video to learn why Newgen is the partner of choice for Georgia’s Own ...

Video

Wilson Bank & Trust’s Take on...

Watch this video to explore how Wilson Bank & Trust, Tennessee is leveraging Newgen's Digital ...

Webinar

Adding Human Touch to Account Opening

On-Demand

Learn with Newgen experts on best practices of account opening and interactive strategies for account ...