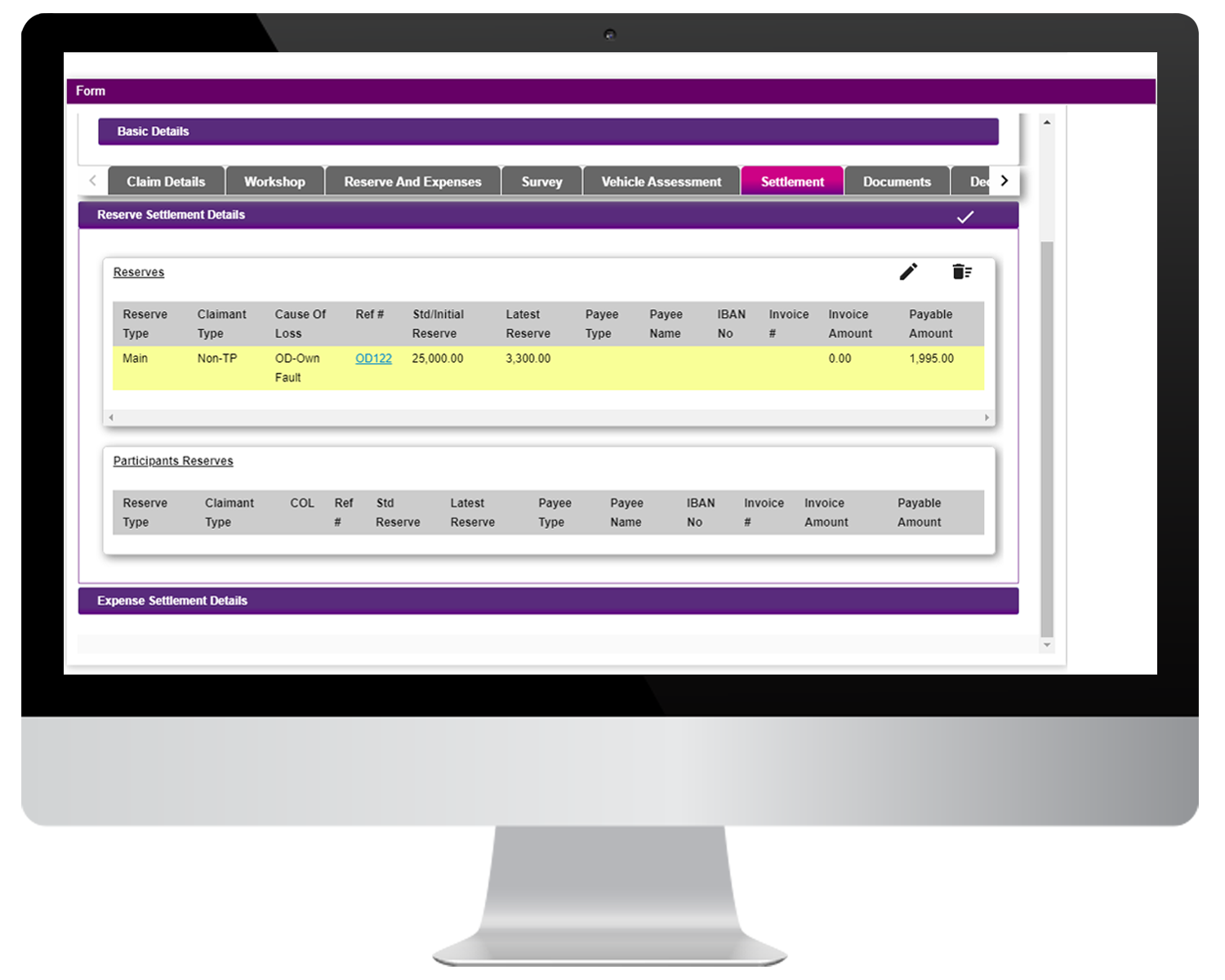

Claims Processing

Streamline the claims lifecycle for fast, accurate, and secure settlement.

Request DemoDownload Brochure

Insurance Claims Management Software

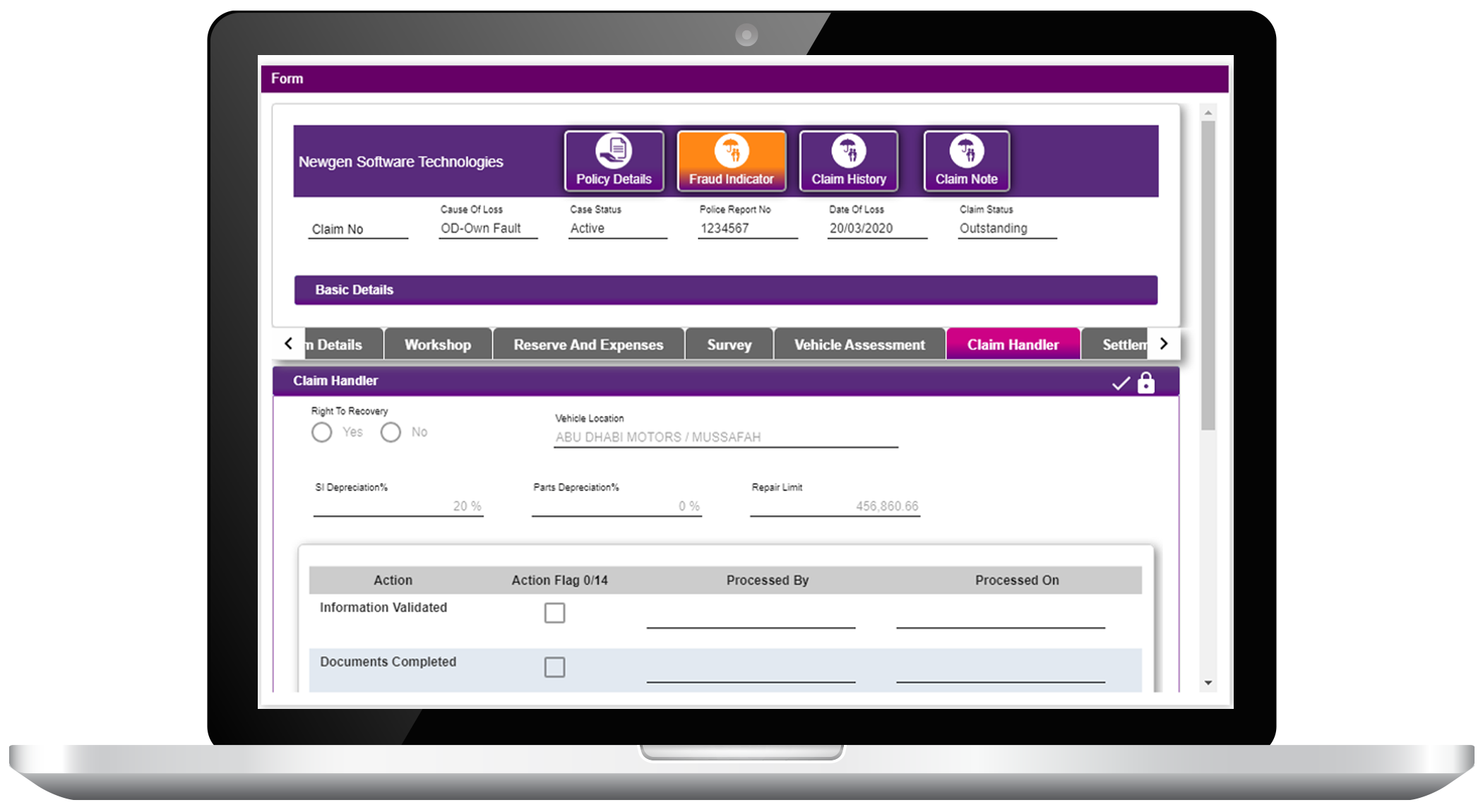

Automate the end-to-end claims journey, from intimation of the first notice of loss and fraud detection to claims adjudication, and finally claims settlement. Experience the flexibility of addressing various claim types differently, like death and maturity claims, while improving regulatory compliance and eliminating non-compliant penalties. Enable faster, accurate, and effective processing through data capture, payment tracking, salvage and recovery tracking, legal matter processing, monitoring, and more.

Customer Self Service Portal

- Customer self-service portal, available via mobile and web-enabled application

- Real-time registration of customer claims and status tracking of submitted claims

Policy Information Retrieval and Verification

- Auto-retrieval of policy information upon entry of key indexing fields

- Claims duplicity prevention and flagging of duplicate entries to avoid errors

Smart Case Routing and Allocation

- Automated case routing based on adjudicator’s workload and experience with handling the case’s level of complexity

- Effective registration, adjudication, tracking, and management of claim submissions

- Seamless tracking and management of claims through a single interface

Rule-based Algorithms

- Built-in, comprehensive business rules for automatically categorizing claims as “fast track” or “non-fast track”

- Flexibility to add or modify stakeholders— garages, assessors, loss adjusters, surveyors, investigators, claim officers, etc.

Thorough Claim Assessment

- Detailed assessment of each claim by providing an all-inclusive dashboard to the assessor

- Request capabilities for additional details based on dynamic needs

Monitoring and Insights

- Defined KPIs to monitor and measure the efficiency of the users

- Escalation matrix and monitoring reports for transparent and timely claims processing

Solutions for Insurance Firms

Success Stories

Learn More

Panel Discussion

Accelerating Digital Transformation in Insurance with Low...

On-Demand

Watch the webinar to understand how a digital transformation platform with low code capability can ...

Case Study

One of the Largest Shipping Companies in Qatar Streamlines...

Newgen automated the client’s accounts payable and receivable processes and provided a single platform to ...

Whitepaper

Selecting the Right Claims Automation Software

Read this guidebook to understand the priorities of modern insurers and how you, as a ...

Case Study

A Fortune 500 Insurer Automates Complaints Management and...

The NewgenONE digital transformation platform enabled the client to streamline multiple processes while ensuring compliance and adherence to security ...