Insurance Underwriting

Issue policies instantly and accurately using an auto-underwriting rules engine.

Request DemoDownload Brochure

Insurance Underwriting Software

Eliminate manual intervention and ensure zero underwriting errors with the auto underwriting rule engine. Meet regulatory requirements and adapt to dynamic business needs with our configurable solution. Automate end-to-end policy issuance process, deliver superior user experience, and ensure a shorter prospect to customer lifecycle.

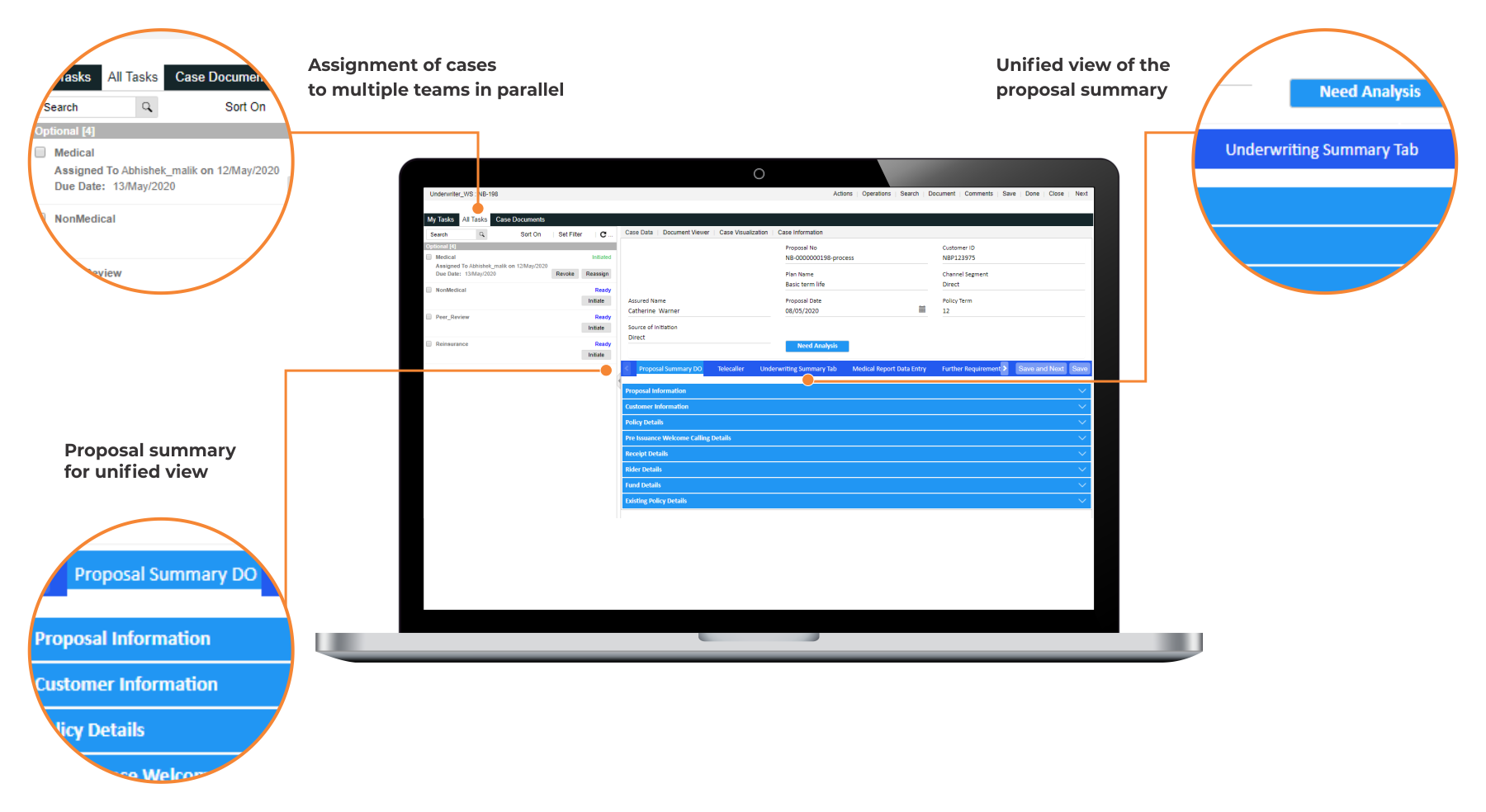

Policy Elements and Underwriting Analysis

- Configurable user interface to define data elements per specific requirements

- Sophisticated dashboards for in-depth data analysis and report generation

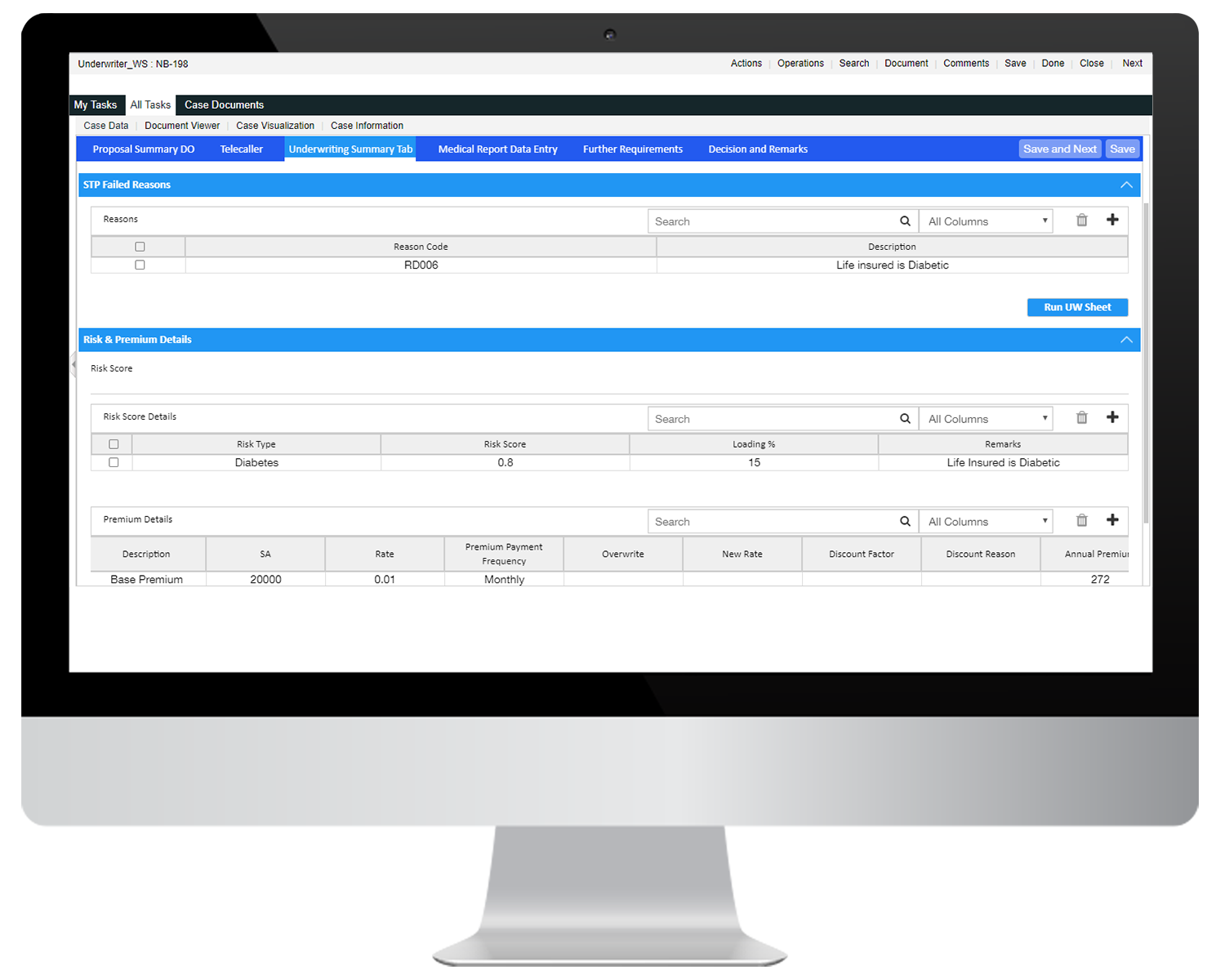

Underwriting Checks and Validations

- Verification and validation, including duplicity checks, anti-money laundering, fraud, blacklisting, etc.

- 360-degree visibility to reduce risk

Core Underwriting Engine

- Dynamic rules to facilitate straight-through processing of low complexity submissions and automate key underwriting tasks

- Abstract underwriting rules and complex logic are configured into the system

- Flexibility to change rules according to dynamic business requirements

Underwriting Evaluation

- Automatic policy evaluation to maximize the percentage of straight-through pass cases for quick policy issuance

- Auto-classification of non-straight-through cases and routing of cases to underwriters based on the authority limit

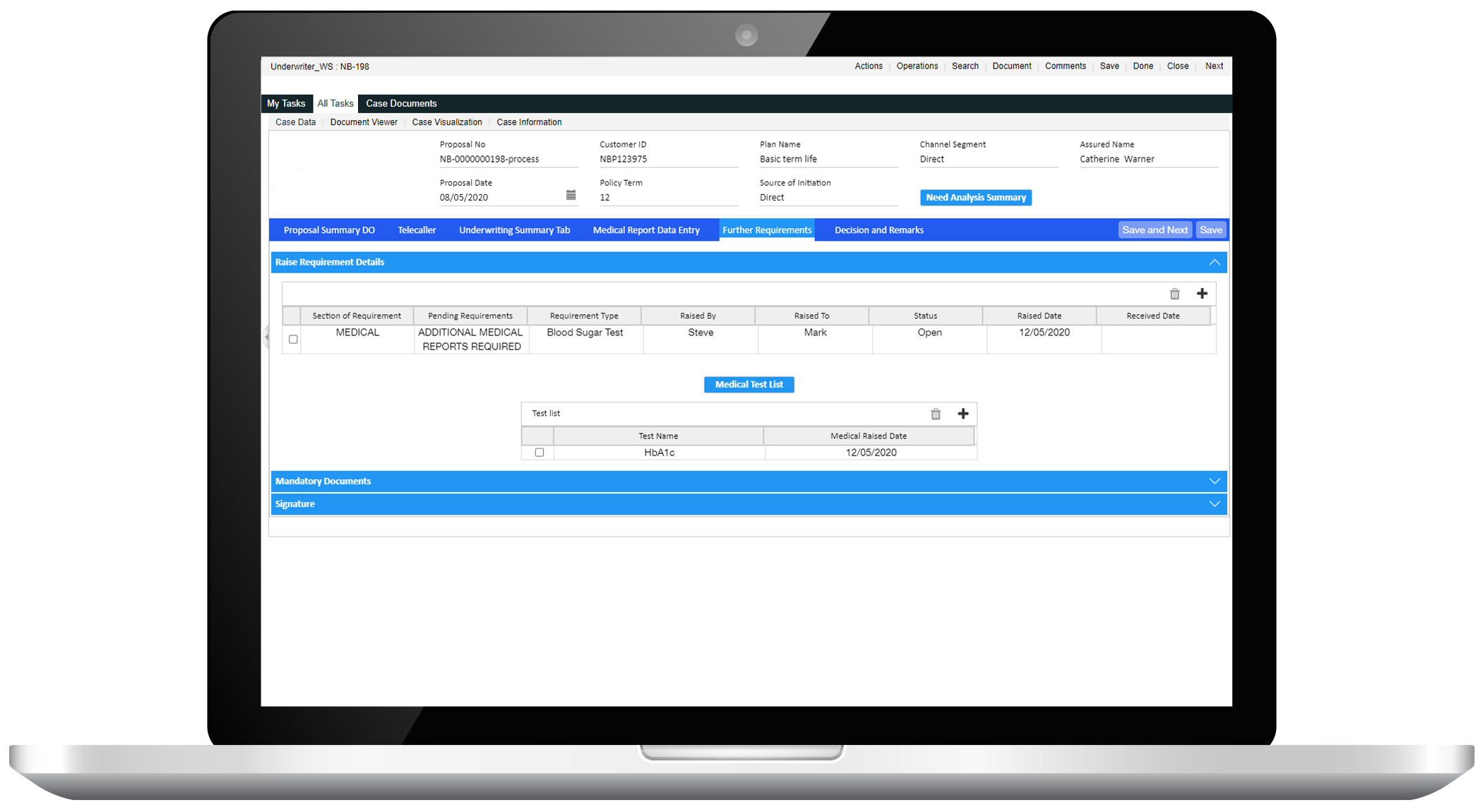

Additional Information Capture

- Access to comprehensive case details to ensure informed decision-making

- Request capabilities for additional documents and information, based on medical or non-medical parameters

Integration and Personalization Capabilities

- Seamless integration with third-party and legacy applications, such as policy administration, CRM, etc.

- Omnichannel, personalized engagement across all channels, including mobile, web, in-person, chatbox, social, and bots

Solutions for Insurance Firms

Success Stories

Learn More

Panel Discussion

Accelerating Digital Transformation in Insurance with Low...

On-Demand

Watch the webinar to understand how a digital transformation platform with low code capability can ...

Case Study

One of the Largest Shipping Companies in Qatar Streamlines...

Newgen automated the client’s accounts payable and receivable processes and provided a single platform to ...

Whitepaper

Selecting the Right Claims Automation Software

Read this guidebook to understand the priorities of modern insurers and how you, as a ...

Case Study

A Fortune 500 Insurer Automates Complaints Management and...

The NewgenONE digital transformation platform enabled the client to streamline multiple processes while ensuring compliance and adherence to security ...