Trade Finance

Improve compliance and efficiency by automating and centralizing standard trade processes.

Request DemoDownload Brochure

Trade Finance Automation Software

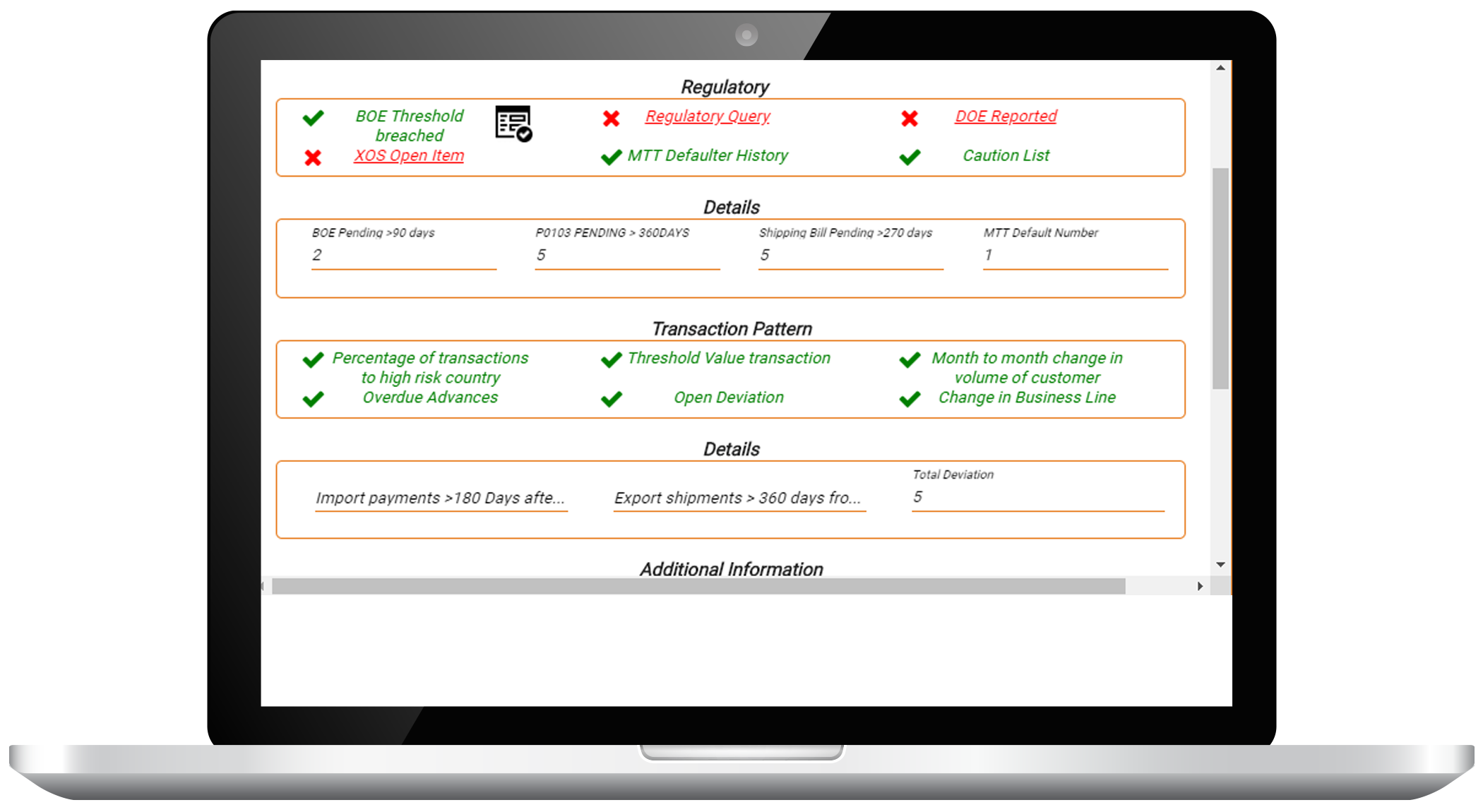

Automate and centralize standard trade finance processes, including export and import-related documentation, negotiation, quotation, and remittances. Ensure adherence to SLAs and regulatory requirements by implementing checklists, efficient tracking of credit documents, and internal controls. Furthermore, increase the scale of operations by extending trade finance services to even low-volume branches.

Multi-channel Trade Process Initiation

- Multi-channel transaction initiation via web portal, handheld device, or branch walk-in

- Automatic retrieval and population of customer details from core banking system

Straight-through Processing

- Elimination of manual case reviews with an automated rules engine

- Direct posting of transactions into the core banking system

Loan Limit Availability Check

- Limit availability checking to fetch and earmark limits, and push the limit utilization data for each transaction

- Instant access to loan account numbers and repayment schedules

Streamlined Online Operations

- Centralized trade operations with online trade finance processing at a central hub

- Improved liquidity with the release of cash otherwise stuck in a complex supply chain

Cost Reduction and Scalability

- Centralized trade operations with online trade finance processing at a central hub

- Improved liquidity with the release of cash otherwise stuck in a complex supply chain

Trade Process Monitoring and Reporting

- Business activity monitoring to track loan requests, processes, and resource utilization, as well as to generate reports and user-specific dashboards

- Master data management module to manage various masters

Solutions for Financial Institutions

Success Stories

LEARN MORE

Case Study

Trade Finance Process Automation at a Leading Private...

The customer is a fast-growing private sector bank in India. The bank was looking for ...

Brochure

Newgen Blockchain-enabled Supply Chain Finance Solution...

Strategic supply chain financing is crucial, determining your relationship with buyers and suppliers. However, the ...

Brochure

Newgen Supply Chain Finance Solution

Managing the supply chain finance is complex and often poses unique challenges, thereby requiring business ...

Brochure

Newgen Supply Chain Finance for Marketplace Solution

The traditional supply chain financing process is paper-heavy and often fraught with errors, thereby leading ...