Small Business Administration Loans

Help small businesses with a full-proof lending process for speed, efficiency, and compliance.

Request DemoDownload Brochure

SBA Lending Software

Automate your small business administration (SBA) lending processes—from submission to qualification, approval, and funding. Operate in a paperless environment and guarantee “first time right” processing to reduce overall expenditures and ensure compliance with regulatory requirements. Deploy on cloud for scalability, lower infrastructural costs, and a faster ROI.

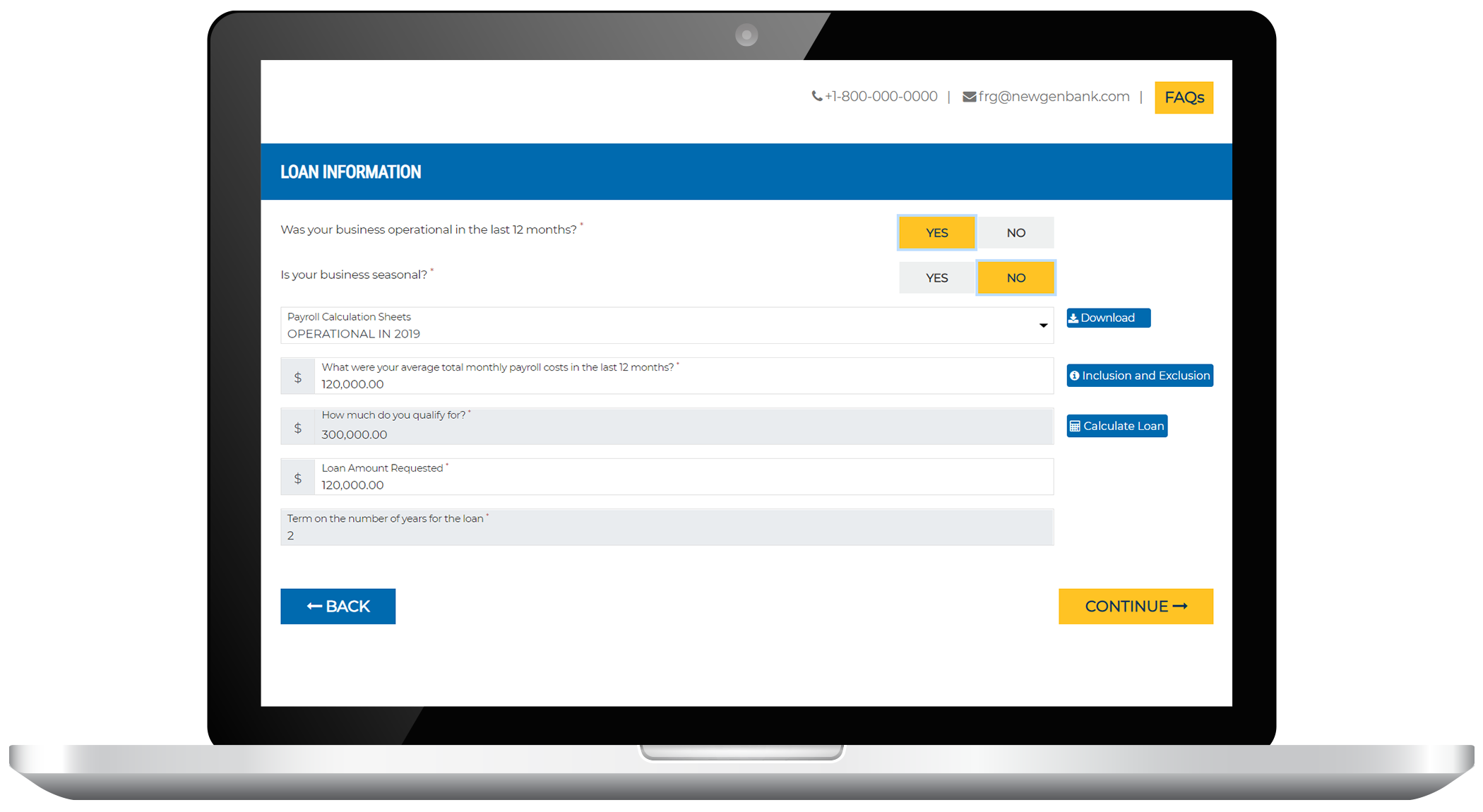

SBA Loan Application Management

- Seamless integration with external loan servicing portals for loan submission without manual intervention

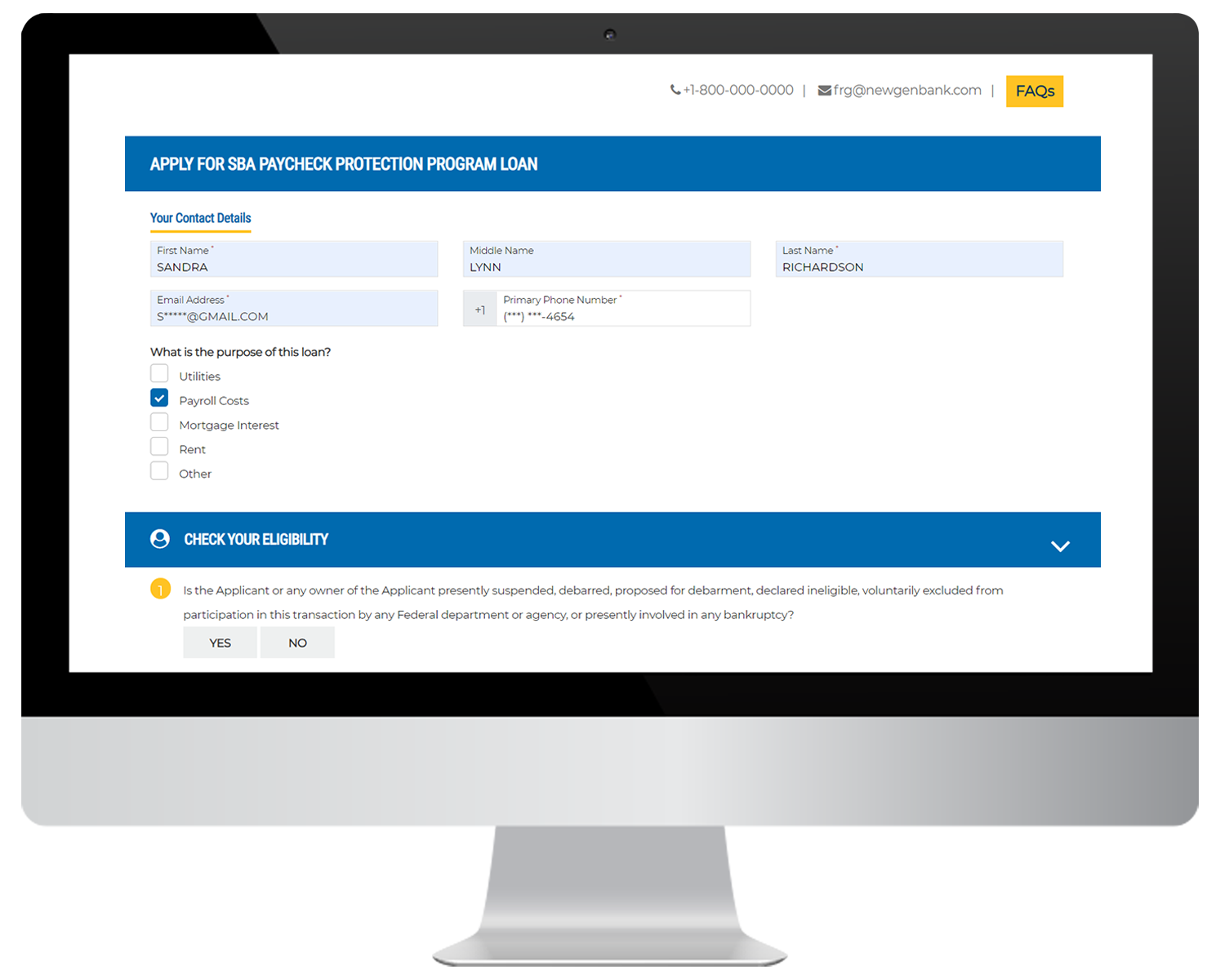

- Omnichannel and cross-channel support and automated eligibility checking for SBA loan applications

Digitized Work Environment

- Reduction in costs related to paper-based workflows, manual intervention, and low employee productivity

- Agile and configurable application to mitigate coding-related costs

Loan Document Checklist and Alerts

- Comprehensive list of necessary documents for loan applications

- Automated alerts in case of deferred documents

Online Customer Loan Portal

- Intuitive online application portal to help users select the right product for their needs

- Single, unified platform to streamline the customer journey

Unified Loan Processes

- Automated underwriting and decisioning of SBA loans based on bank rules

- Unified loan processes to eliminate redundant data entry and aggregate information across disparate systems

Configurable Rules-based Processing

- Built-in rules and credit policies to ensure regulatory compliance

- Compliance with dynamic SBA guidelines and requirements

Solutions for Lending

Success Stories

Improved retail loan processing capacity by 80%

45% faster commercial loan disbursal

Increased same-day loan disbursal by 65%

Learn more

Webinar

Newgen Loan Origination Solution – A Game Changer for...

On-Demand

Join EDMS Consultants Sdn Bhd and Newgen Software in this webinar on January 27, 2022, ...

Webinar

Newgen Loan Origination Solution – A Game Changer for...

On-Demand

Join First Cambodia Co. Ltd. and Newgen Software in this webinar on January 19, 2022, ...

Video

Digital business lending solution

Watch our 60-minute webinar on demand to hear about Newgen's Digital business lending solution.

Whitepaper

Transforming Consumer Lending with Connected Banking

Today many banks and credit unions can support online loan applications. However, the process still ...