Commercial Loan Origination Software

Intelligently disburse and manage commercial loans for a seamless customer experience.

Request DemoDownload BrochureCommercial Loan Origination Software

Originate, process, disburse, and monitor commercial loans with our commercial loan origination software, built on a unified digital platform. Gain better insights into your high-profile accounts to enhance profitability and underwrite loans competitively. Leverage online, self-service portals for various stakeholders, including borrowers, brokers, appraisers, and more, to ensure seamless communication and request fulfillment. Achieve a faster go-to-market and stay on top of regulatory requirements, all while empowering your relationship managers with the tools to deliver an unparalleled customer experience.

Single platform for all loan products

- Supports C&I, CRE, SBA, Small business, Consumer lending products

- Automated segregation of loans based on loan value, loan type, and exposure

Digital Channels for new age lending

- Omni-channel portals for borrowers for loan submission

- Portal access for all participants in the loans including brokers, vendors, attorneys, participants etc.

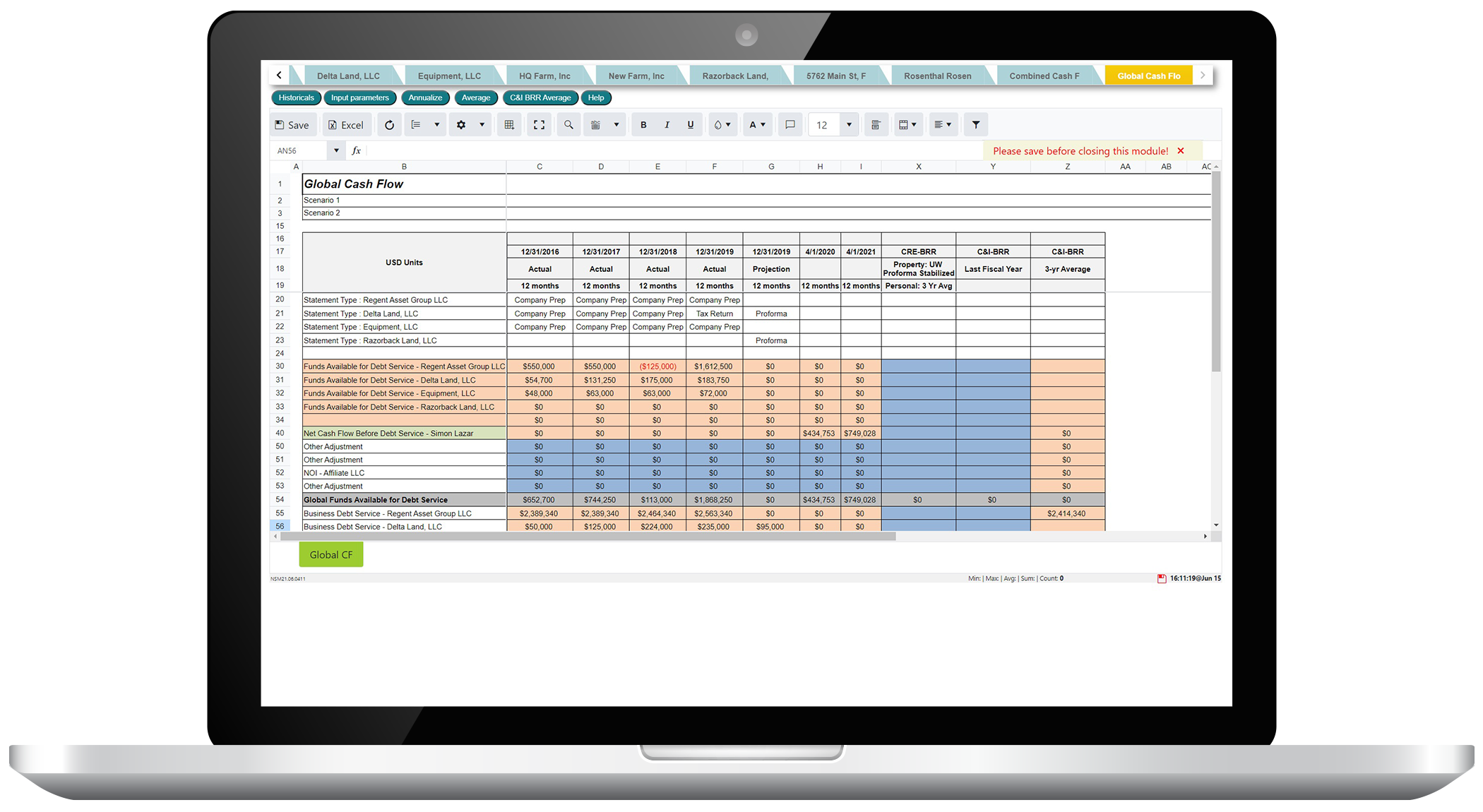

Intelligent Underwriting and Risk Rating

- Configurable spreading with individual, entity, and collateral analysis with flexible loan presentation

- Rule-based, configurable risk rating module and workflow-based exception management and tracking

Portfolio Monitoring and Analysis

- Portfolio monitoring and automated tracking and retrieval of collaterals and covenants

- Automated validations and customer alerts through the borrower portal, related to missing data and documents

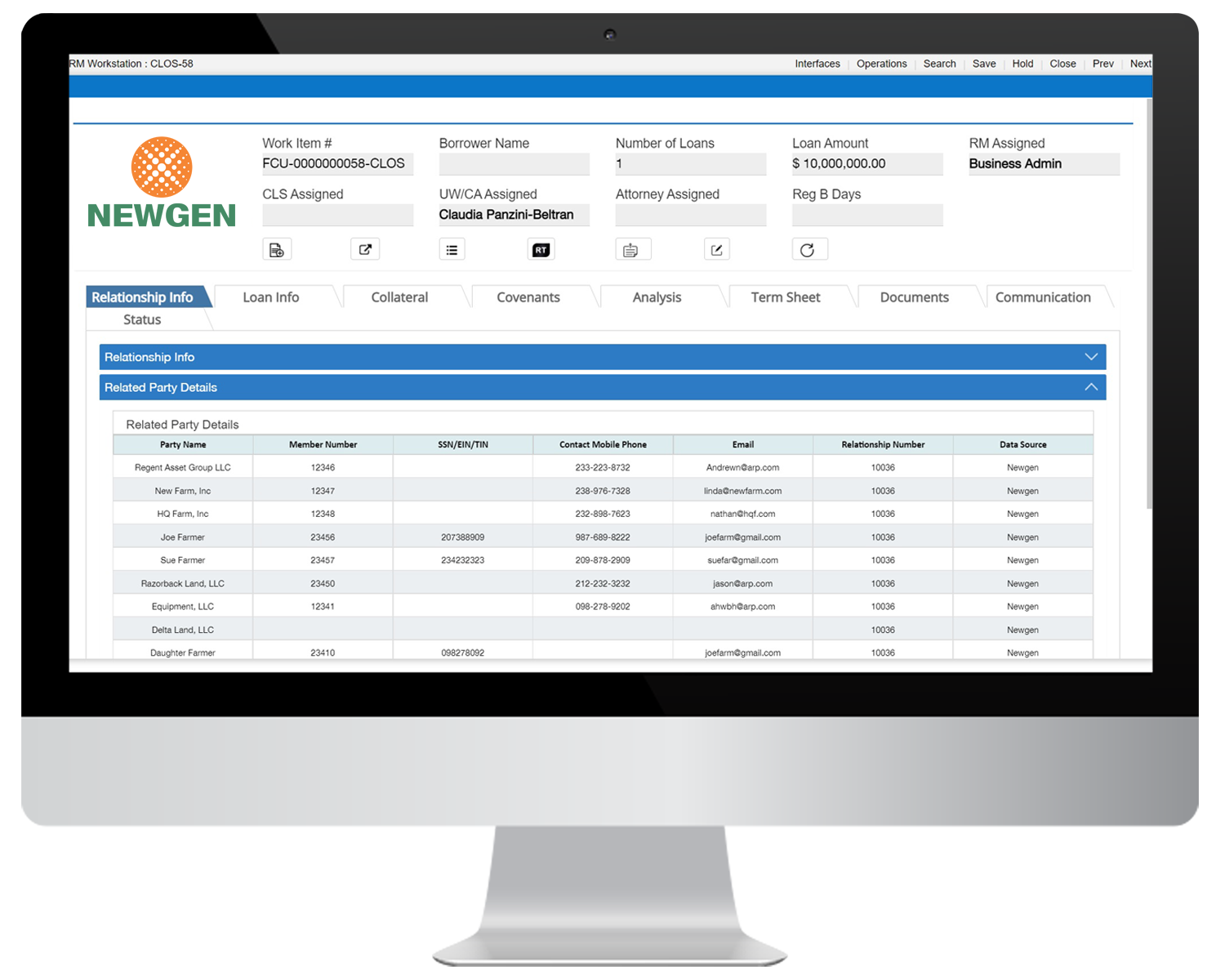

Management of Leads and Customer Relationships

- Integrated prospecting module to manage and review customer relationships

- Lead management capabilities, including lead creation, activity scheduling, reminders, and pipeline management

Integrated Loan Closing

- Tight integration with document preparation engines for generating loan package

- Automated requests to attorneys for document generation and coordination through attorney portal

Integrated Experience

- Real time integration with CRM, credit bureaus, flood check, appraisal sites, doc prep engine, e-sign applications, and core banking system

- Single view for all participants in lending process. No duplicate data entry

360-degree Visibility

- Dashboards to generate operational, productivity, and investigative reports

- Real-time alerts on critical business events, including non-compliance and delinquent loans

Ensuring Real Outcomes for Every Role

Responsible for overall business strategy, CEOs can leverage Newgen’s commercial lending software to ensure cost efficiency while maintaining credit compliance, managing risk, and overseeing credit growth. All of this enables them to deliver a greater ROI to stakeholders, including customers, employees, and partners.

- Increased profitability and revenue

- Quicker loan disbursal

- Higher volume of loan originations

- Rapid deployment for a faster ROI

- Faster time to market

With a focus on monitoring and growing credit, CLOs can maintain a healthy portfolio mix, drive market penetration, and reduce costs by leveraging a robust commercial lending solution. This further allows them to manage stakeholder relationships and ensure a faster ROI.

- Simplified communication using digital portals

- Improved productivity of loan officers and underwriters

- Shorter turnaround times

- Automated decisions for small value loans

- Greater frequency of first time right processing

COOs are responsible for streamlining operations, maintaining efficiencies, and ensuring real-time visibility and transparency across all processes. A commercial loan origination software can help them seamlessly manage documentation, loan servicing, funding, and closing, among other things.

- Increased number of loans serviced per staff (FTE)

- Improved productivity and an optimized workforce

- Centralized document access and processing

- Reduced operational costs

- Enhanced application tracking and monitoring

Responsible for ensuring compliance and mitigating risk, CROs can implement a robust commercial loan origination software to safeguard their organization. The software can help CROs manage credit risk, control risk distribution, ensure effective risk rating, and much more.

- Enhanced portfolio risk monitoring and mitigation

- Dynamic credit risk modeling

- More effective risk rating models and scorecards

- Ensured continuous improvement

- Integrated financial analysis

- Improved data governance and management

CIOs are primarily responsible for ensuring technological advancement and modernization. With a commercial loan origination software, they can develop and implement new or upgraded systems, while ensuring scalability and adaptability, to support business goals.

- Modern, adaptable, and configurable software built on a low code platform

- Stronger data analytics and a centralized repository for data and documents

- Quicker provisioning with cloud deployment

- Ease of integration with core and third-party systems

- Lower maintenance costs

Integrations

Solutions for Lending

Success Stories

Improved retail loan processing capacity by 80%

45% faster commercial loan disbursal

Increased same-day loan disbursal by 65%

Learn more

Webinar

Newgen Loan Origination Solution – A Game Changer for...

On-Demand

Join EDMS Consultants Sdn Bhd and Newgen Software in this webinar on January 27, 2022, ...

Webinar

Newgen Loan Origination Solution – A Game Changer for...

On-Demand

Join First Cambodia Co. Ltd. and Newgen Software in this webinar on January 19, 2022, ...

Video

Digital business lending solution

Watch our 60-minute webinar on demand to hear about Newgen's Digital business lending solution.

Whitepaper

Transforming Consumer Lending with Connected Banking

Today many banks and credit unions can support online loan applications. However, the process still ...