Consumer/Retail Lending

Automate your retail lending process to manage risk and increase efficiency.

Request DemoDownload BrochureConsumer/Retail Loan Origination Software

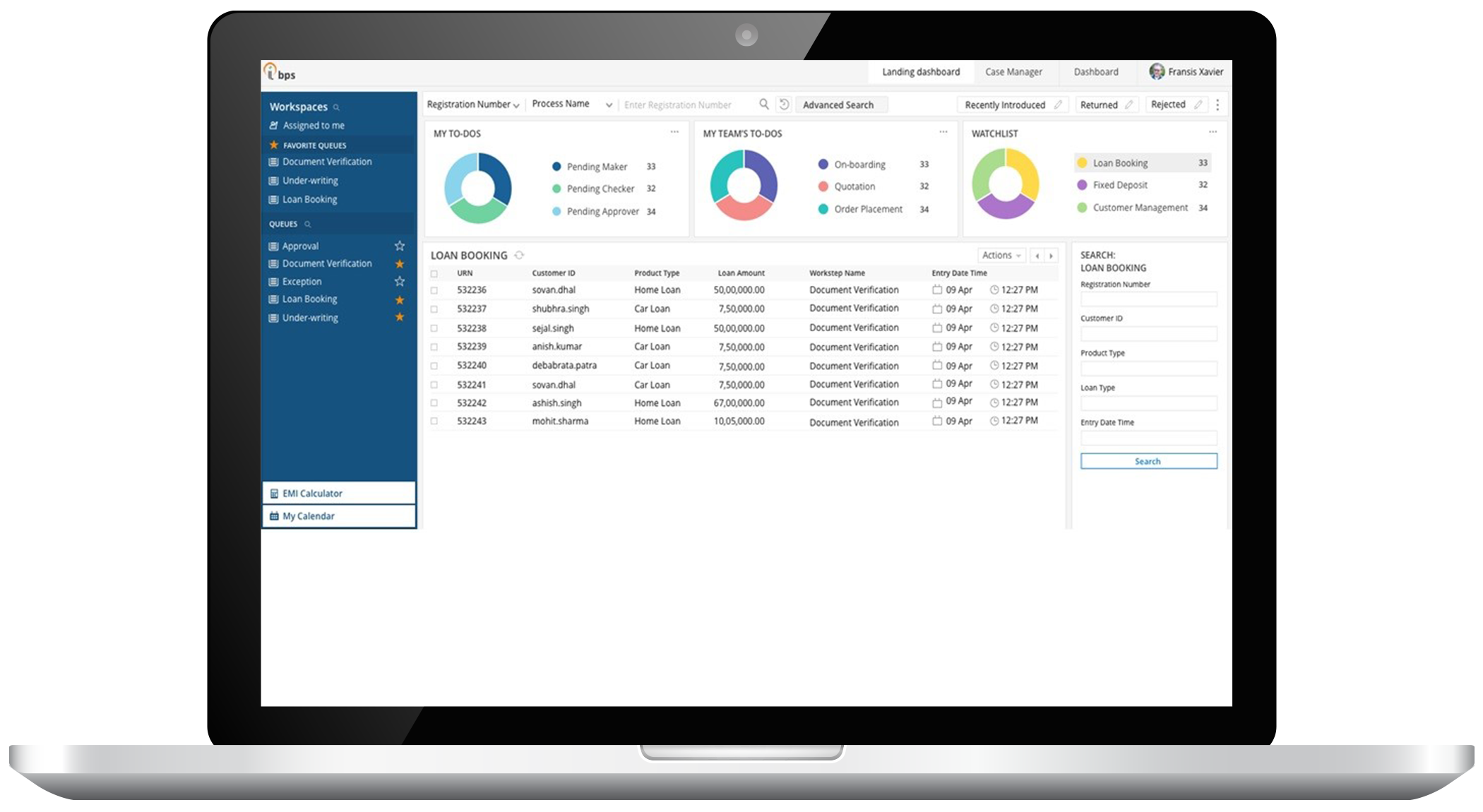

Revitalize your retail loan origination process by implementing a flexible and responsive consumer lending application, built on our digital transformation platform. Enable digital experience, automated underwriting, instant decisioning, and efficient exception management. Ensure a straight-through, simplified loan disbursement for allproducts, including credit cards and personal loans, without any manual intervention. Leverage digital collaboration for high-touch loans—HELOC, home equity loans, etc.—for a faster turnaround time. Utilize real-time dasboards for tracking processes, pipelines, and productivity.

Digitized Lending Processes

- Transformed consumer loan origination with end-to-end automation of loan requests, underwriting, approval, closing, and booking processes in a paperless environment

- Straight-through processing for quicker loan approval and disbursements

- Support for no-touch, low-touch, and high-touch loans processing

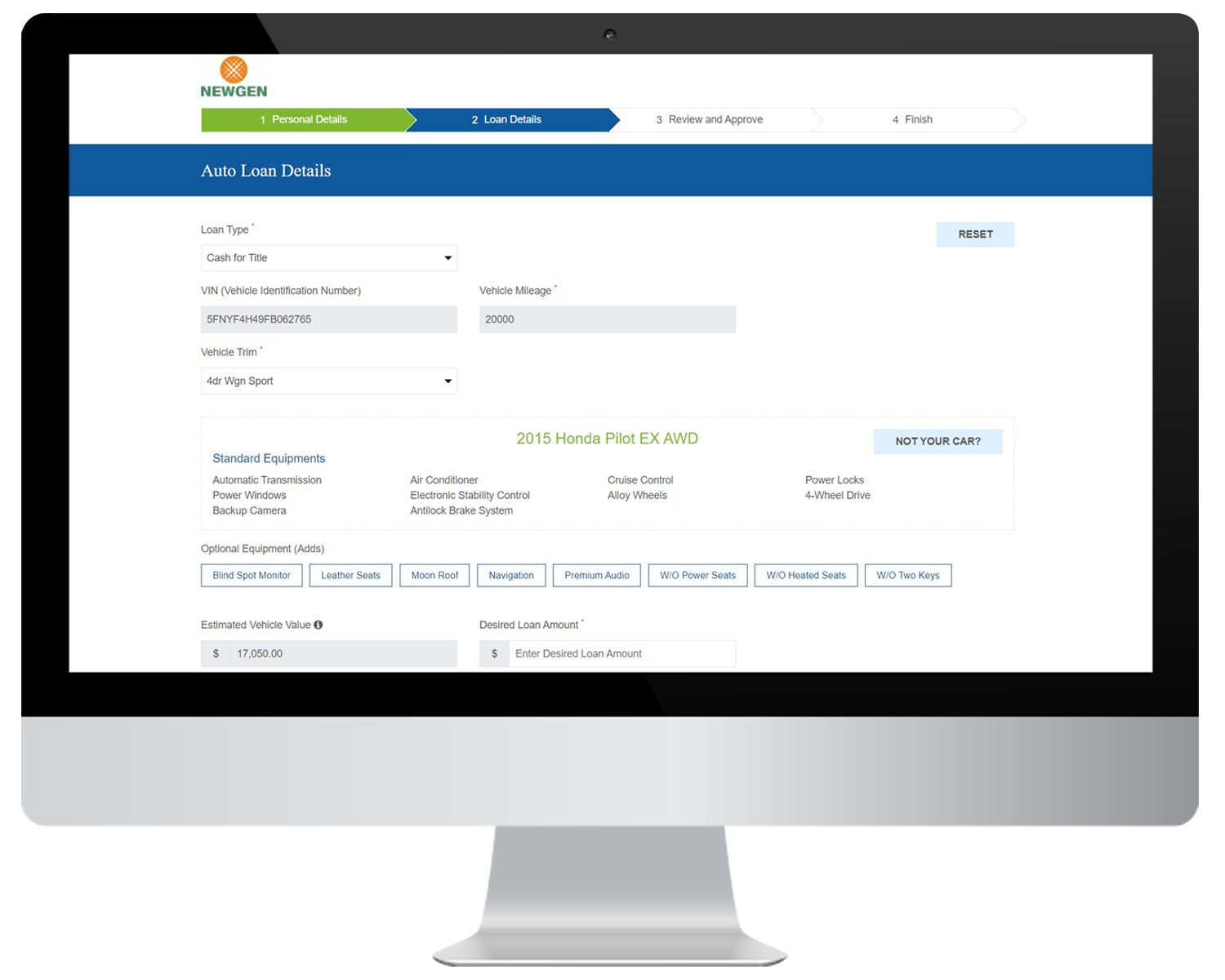

Multi-channel Loan Application

- Omnichannel and multi-device initiation of loan applications

- Intuitive self-service customer portals and real-time status tracking

- Auto-underwriting and online approvals/soft-approvals

Risk Management

- Identity verification/authentication and fraud management through third-party integrations

- IP-based/device-based filters for applications

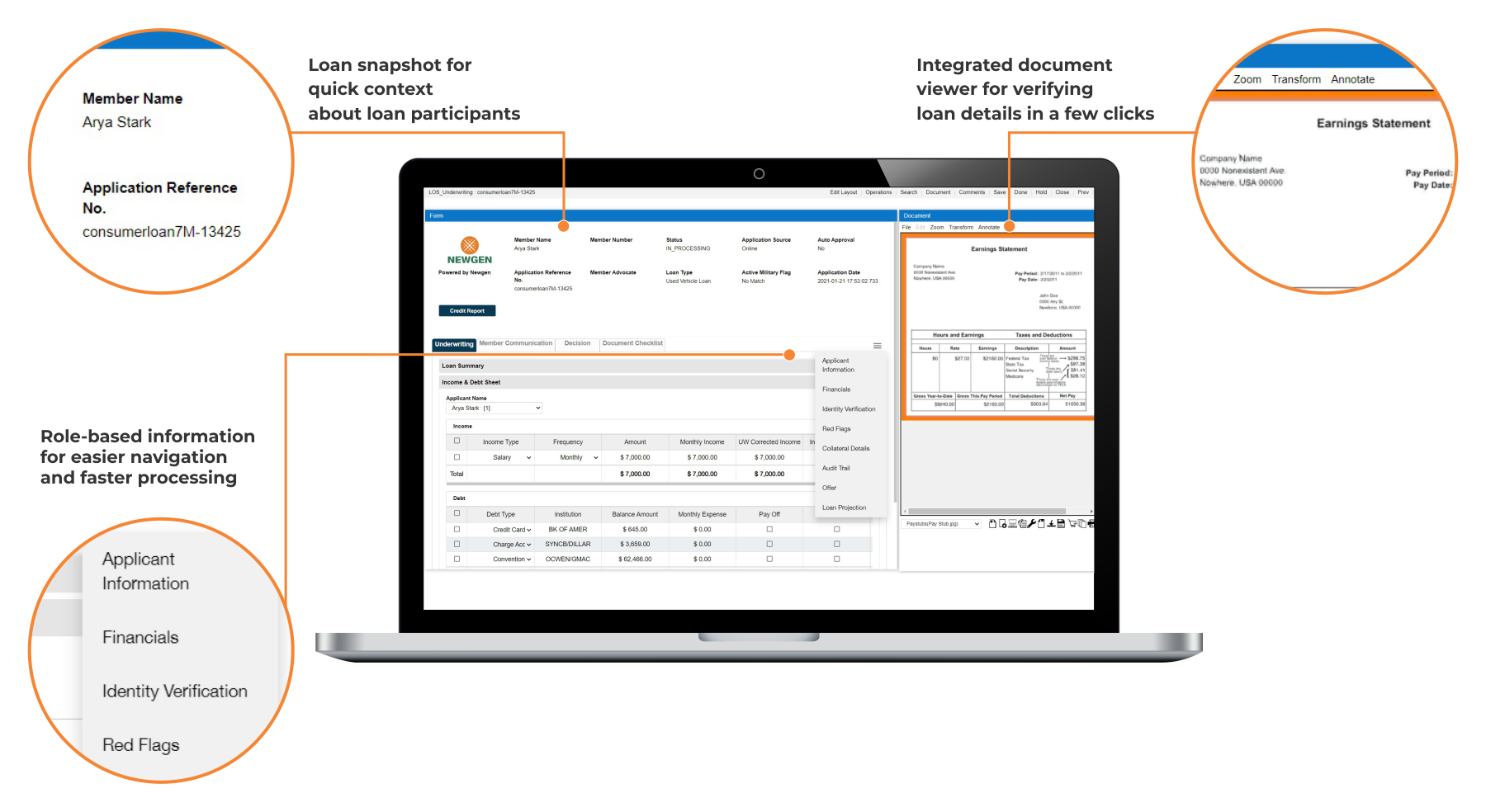

Intelligent Underwriting and Configurable Rules

- Intelligent underwriting and credit analysis processes driven by business rules and scoring models

- Rules engine for business owners to apply the required policies and exception rules

- Customer and product-specific data capture through configurable templates

Audit and Reporting

- Comprehensive auditing capabilities for increased compliance with dynamic regulatory requirements

- Real-time reports with process insights for continuous process improvements

- Drilled-down monitoring of productivity, pipeline, and service levels

Integration with Third-party Systems

- Real-time integration with core banking and online banking for seamless lending experience

- Third-party integration with rating applications, credit bureau systems, and more

Integrations

Solutions for Lending

Success Stories

Improved retail loan processing capacity by 80%

45% faster commercial loan disbursal

Increased same-day loan disbursal by 65%

Learn more

Webinar

Newgen Loan Origination Solution – A Game Changer for...

On-Demand

Join EDMS Consultants Sdn Bhd and Newgen Software in this webinar on January 27, 2022, ...

Webinar

Newgen Loan Origination Solution – A Game Changer for...

On-Demand

Join First Cambodia Co. Ltd. and Newgen Software in this webinar on January 19, 2022, ...

Video

Digital business lending solution

Watch our 60-minute webinar on demand to hear about Newgen's Digital business lending solution.

Whitepaper

Transforming Consumer Lending with Connected Banking

Today many banks and credit unions can support online loan applications. However, the process still ...