Small Business Lending

Deploy small business lending automation software within weeks and improve profitability and scalability.

Request DemoDownload Brochure

Small Business Lending Software

Streamline small business lending processes and reduce turnaround time by rapidly deploying purpose-built lending automation software. Enable unified processing by integrating the software with your existing loan origination system (LOS) or Newgen’s LOS. Furthermore, allow multi-channel document submission, customer verification, smarter decision-making, seamless loan booking, increased productivity of lenders, and enhanced customer experience. Deploy the software in phases, per your bank’s needs – online, back office, or full-fledged loan origination software.

Newgen’s Commercial Loan Origination Software

Ensuring Real Outcomes for Every Role

Responsible for overall business strategy, CEOs can leverage Newgen’s commercial lending software to ensure cost efficiency while maintaining credit compliance, managing risk, and overseeing credit growth. All of this enables them to deliver a greater ROI to stakeholders, including customers, employees, and partners.

- Increased profitability and revenue

- Quicker loan disbursal

- Higher volume of loan originations

- Rapid deployment for a faster ROI

- Faster time to market

With a focus on monitoring and growing credit, CLOs can maintain a healthy portfolio mix, drive market penetration, and reduce costs by leveraging a robust commercial lending solution. This further allows them to manage stakeholder relationships and ensure a faster ROI.

- Simplified communication using digital portals

- Improved productivity of loan officers and underwriters

- Shorter turnaround times

- Automated decisions for small value loans

- Greater frequency of first time right processing

COOs are responsible for streamlining operations, maintaining efficiencies, and ensuring real-time visibility and transparency across all processes. A commercial loan origination software can help them seamlessly manage documentation, loan servicing, funding, and closing, among other things.

- Increased number of loans serviced per staff (FTE)

- Improved productivity and an optimized workforce

- Centralized document access and processing

- Reduced operational costs

- Enhanced application tracking and monitoring

Responsible for ensuring compliance and mitigating risk, CROs can implement a robust commercial loan origination software to safeguard their organization. The software can help CROs manage credit risk, control risk distribution, ensure effective risk rating, and much more.

- Enhanced portfolio risk monitoring and mitigation

- Dynamic credit risk modeling

- More effective risk rating models and scorecards

- Ensured continuous improvement

- Integrated financial analysis

- Improved data governance and management

CIOs are primarily responsible for ensuring technological advancement and modernization. With a commercial loan origination software, they can develop and implement new or upgraded systems, while ensuring scalability and adaptability, to support business goals.

- Modern, adaptable, and configurable software built on a low code platform

- Stronger data analytics and a centralized repository for data and documents

- Quicker provisioning with cloud deployment

- Ease of integration with core and third-party systems

- Lower maintenance costs

Zero-touch Processing and Efficient Lead Generation

- Straight-through processing and immediate approval of online loan applications with an auto-decisioning engine

- Efficient lead management and handling of cross and up-sell opportunities

Multi-channel Document Submission

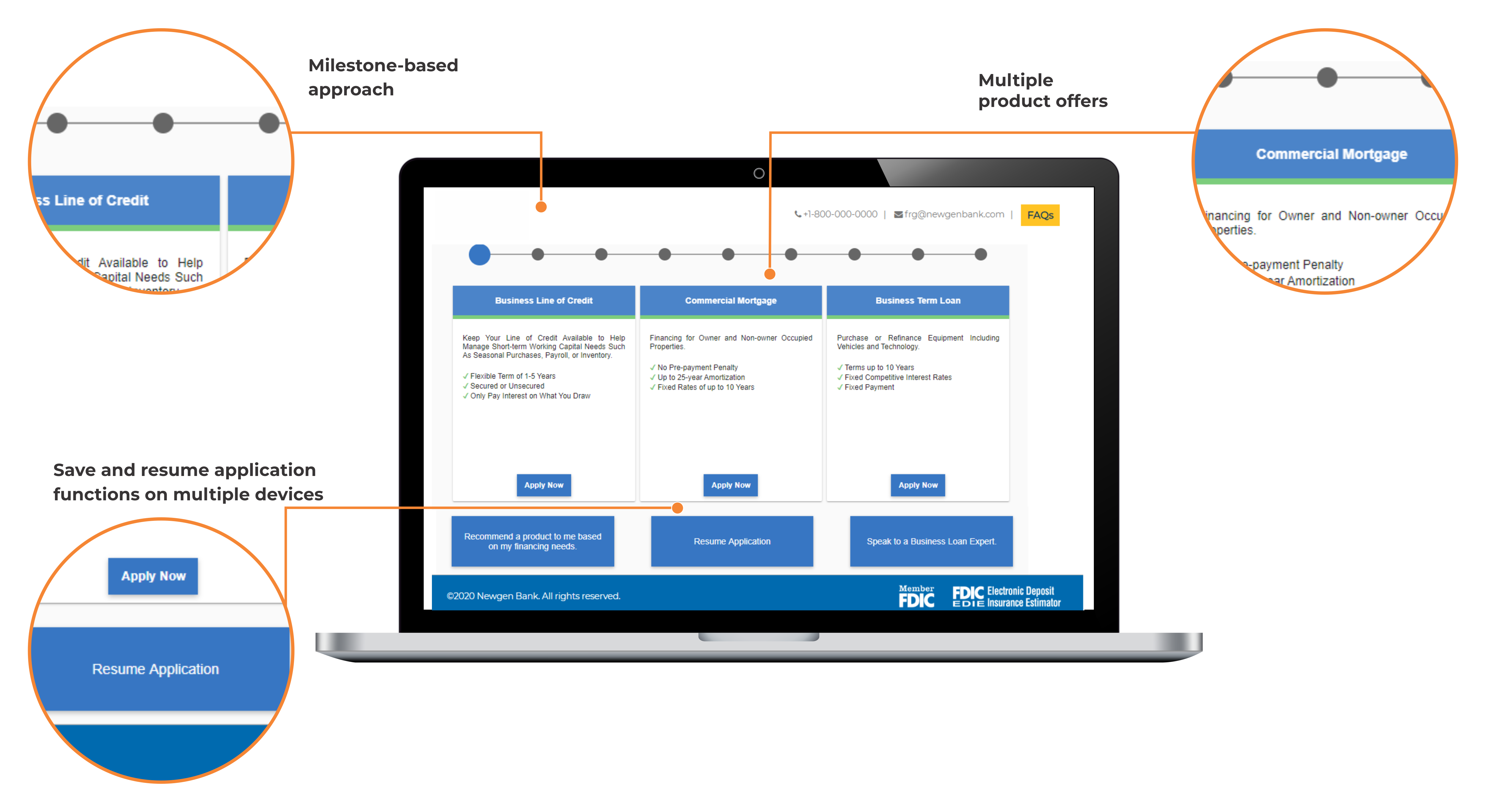

- Flexibility for customers to apply online, in-branch or call center and save/resume applications from any channel

- Self-service for document upload and status tracking

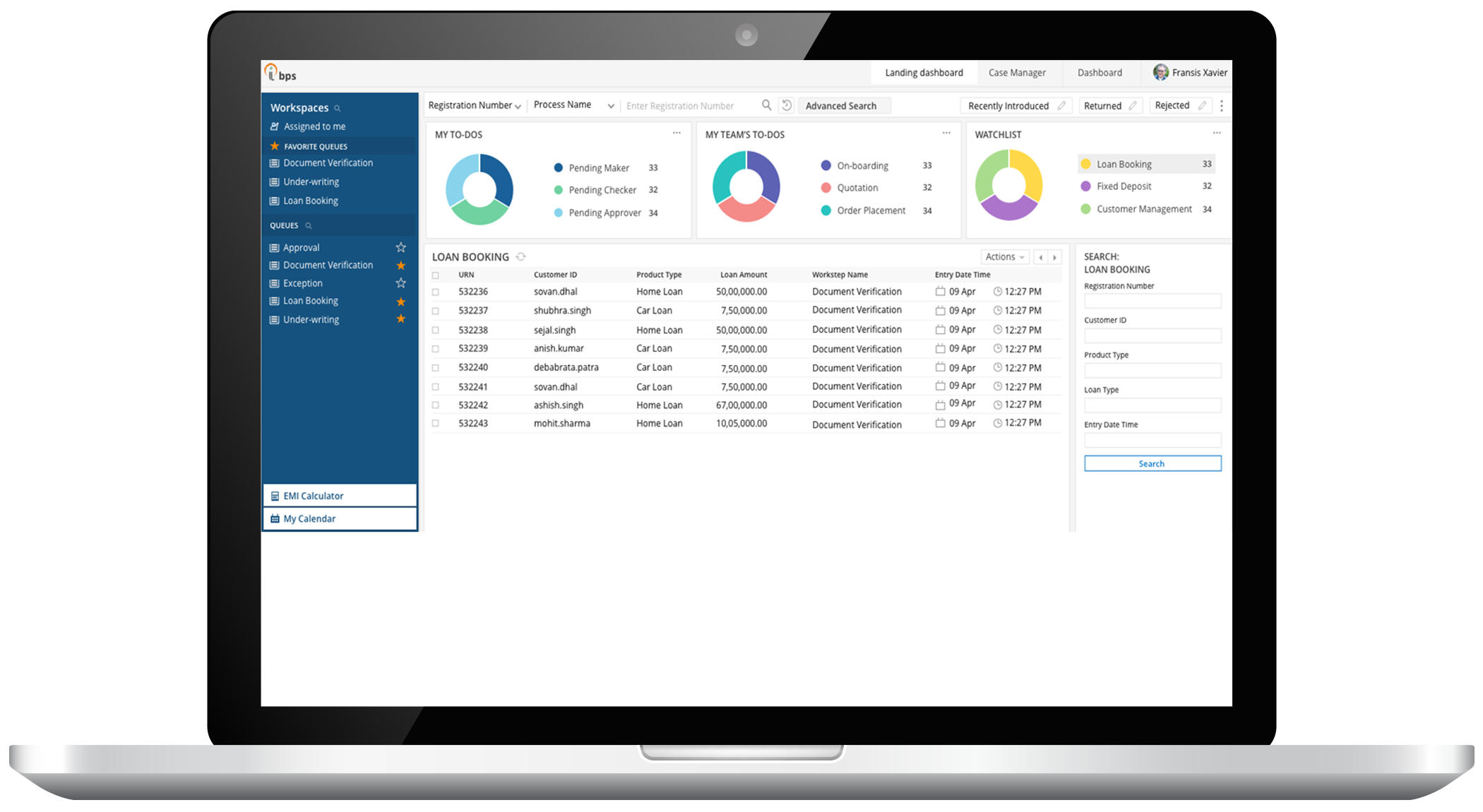

Back Office Review Workspace

- Personalized workspace for lenders for reviewing incomplete/incorrect applications and loan exceptions with SLA alerts

- Loan package generation with small business loan documents

Credit Analysis and Monitoring

- Comprehensive credit analysis per client needs including financial information, credit profile, ratios, and account history

- 360-degree visibility into the lending cycle, trends, exceptions, and productivity using the reporting engine

Seamless Integration

- Seamless integration with tools for identity verification/authentication, fraud check, OFAC, and blacklist check

- Integration of loan documents with existing document preparation engine

Solutions for Lending

Success Stories

Improved retail loan processing capacity by 80%

45% faster commercial loan disbursal

Increased same-day loan disbursal by 65%

Learn more

Webinar

Newgen Loan Origination Solution – A Game Changer for...

On-Demand

Join EDMS Consultants Sdn Bhd and Newgen Software in this webinar on January 27, 2022, ...

Webinar

Newgen Loan Origination Solution – A Game Changer for...

On-Demand

Join First Cambodia Co. Ltd. and Newgen Software in this webinar on January 19, 2022, ...

Video

Digital business lending solution

Watch our 60-minute webinar on demand to hear about Newgen's Digital business lending solution.

Whitepaper

Transforming Consumer Lending with Connected Banking

Today many banks and credit unions can support online loan applications. However, the process still ...